Payment to a retiring partner can be made in the following ways

(i) Lump Sum Payment : A lump sum payment can be made to the retiring partner in full settlement. In that case, the following Journal entry will be passed

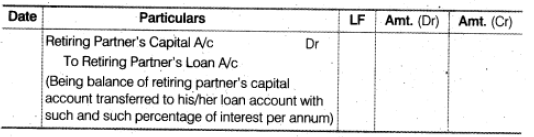

(ii) Opening the Loan Account: Sometimes the amount due to the retiring partner is paid in instalments then the balancing figure of his/her capital account is transferred to his/her loan account, in this case, the retiring partner receives equal instalments along with the interest on the amount outstanding. In that case the following journal entries will be passed for transferring the amount paid to him/her in retiring partner’s loan account.

(iii)Some Payment in Cash and Some in Instalment: Sometimes the amount due to the retiring partner is paid partly in cash and partly in equal instalments in that case a certain amount is paid in cash to the retiring partner and the rest amount due to him/her is transferred to his/her loan account. The following necessary journal entry is to be passed.