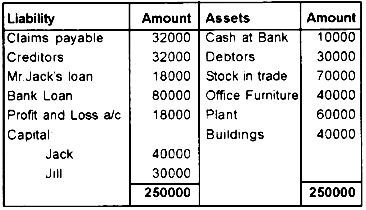

Jack and Jill are partners sharing profits in the ratio of 3:2. They decided to close the firm and their Balance Sheet is given below:

Assets realised as follows:

Buildings Rs. 32000

Debtors Rs.28000

Furniture Rs.36000

Liabilities settled as follows:

Plant has been taken over by Bank at Rs. 66,000 in respect of the loan granted by the Bank and the rest has been paid in cash. Creditors are settled at Rs. 30,000

Realisation expenses came to Rs. 1000 which have been met by Jill. Prepare necessary accounts to dissolve the firm and ascertain the amount due to or due from the partners.