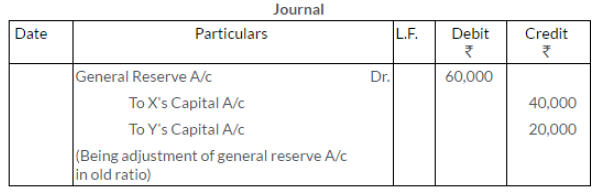

(i) If they do not want to show general reserve in the new Balance sheet

WN1. Calculation of share of General reseve

(ii) If they want to show general reserve in the new balance sheet

Working Notes :

1.Calculation of Gain /sacrifice

Sacrificing Ratio = Old Ratio - New Ratio

2. Calculation of compensation by Y to X