Working Note :

Working Note :

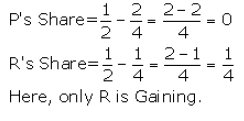

1. calculation of gaining ratio

old ratio (P,Q and R ) = 2:1:1

Q retires from the firm

New Ratio (p and R) = 1 : 1:1

gaining ratio = New ratio - old ratio

2. Adjustment of goodwill

goodwill of the firm = Rs.40,000

This share of goodwill is to be debited to R's capital account.