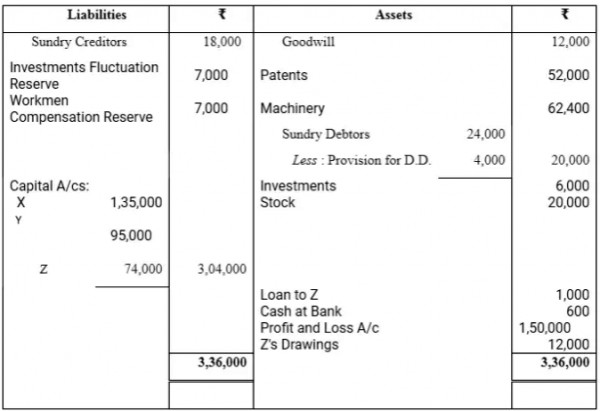

X, Y and Z are partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. Their Balance Sheet as at 31st March, 2018 was as follows:

Z died on 1st April, 2018, X and Y decide to share future profits and losses in ratio of 3 : 5. It was agreed that:

(i) Goodwill of the firm be valued 2 years purchase of average of four completed years profits which were : 2014-15 – Rs. 1,00,000; 2015-16 – Rs. 80,000; 2016-17 – Rs. 82,000.

(ii) Stock undervalued by Rs. 14,000 and machinery overvalued by Rs. 13,600. All debtors are good. A debtor whose dues of Rs. 400 were written off as bad debts paid 50% in full settlement. Out of the amount of insurance premium which was debited entirely to Profit and Loss Account Rs. 2,200 be carried forward as an unexpired insurance premium. Rs. 1,000 included in Sundry Creditors is not likely to arise. A claim of Rs. 1,000 on account of Workmen Compensation to be provided for.

(iii) Investment be sold for Rs. 8,200 and a sum of Rs. 11,200 be paid to execution of Z immediately. The balance to be paid in four equal half-yearly installments together with interest @ 8% p.a. at half year rest. Show Reavaluation Account, Capital Accounts of Partners and the Balance Sheet of the new firm.