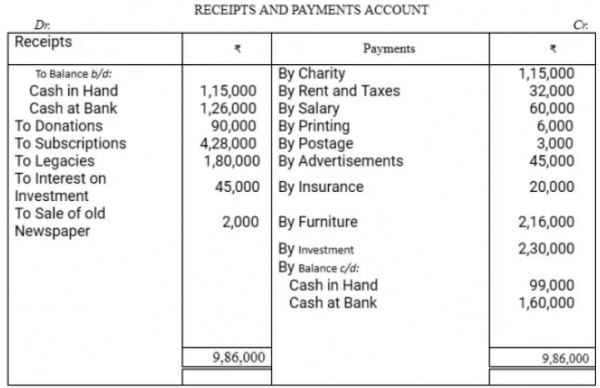

Following Receipts and Payments Account was prepared from the Cash Book of Delhi Charitable Trust for the year ending 31st March, 2019:

Prepare Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as on that date after the following adjustments:

(i) Insurance premium was paid for insurance taken w.e.f. 1st July 2018.

(ii) Interest on investment ₹ 11,000 accrued was not received.

(iii) Rent ₹ 6,000; Salary ₹ 9,000 and advertisement expenses ₹ 10,000 outstanding as on 31st March 2019.

(iv) Legacy Donation is towards the construction of Library Block.