(i) Cash Flows from Operating Activities using direct method

Working Notes

(a) Effect of sales on cash can be computed as follows:

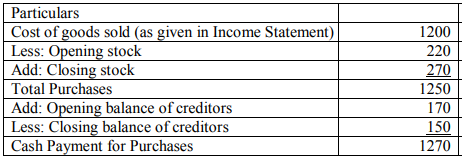

(b) Cash movement due to purchases can be ascertained as follows:

(c) Disbursement of cash for expenses can be calculated as follows:

(ii) Calculation of cash from operating activities using indirect method

Thus, it can be observed from the above calculations that the amount of cash flows from operating activities is the same whether we use direct method or indirect method.