The following are the limitations of financial statements.

1. Historical Data: The items recorded in the financial statements reflect their original cost i.e. the cost at which they were acquired. Consequently, financial statements do not reveal the current market price of the items. Further, financial statements fail to capture the inflation effects.

2. Ignorance of Qualitative Aspect: A financial statement does not reveal the qualitative aspects of a transaction. The qualitative aspects like colour, size and brand position in the market, employee’s qualities and capabilities are not disclosed by the financial statements.

3. Biased: Financial statements are based on the personal judgments regarding the use of methods of recording. For example, the choice of practice in the valuation of inventory, method of depreciation, amount of provisions, etc. are based on the personal value judgments and may differ from person to person. Thus, the financial statements reflect the personal value judgments of the concerned accountants and clerks.

4. Inter-firm Comparisons: Usually, it is difficult to compare the financial statements of two companies because of the difference in the methods and practices followed by their respective accountants.

5. Window dressing: The possibility of window dressing is probable. This might be because of the motive of the company to overstate or understate the assets and liabilities to attract more investors or to reduce taxable profit. For example, Satyam showed high fixed deposits- in the Assets side of its Balance Sheet for better liquidity that gave false and misleading signals to the investors.

6. Difficulty in Forecasting: Since the financial statements are based on historical data, so they fail to reflect the effect of inflation. This drawback makes forecasting difficult. Prepare the format of income statement and explain its elements

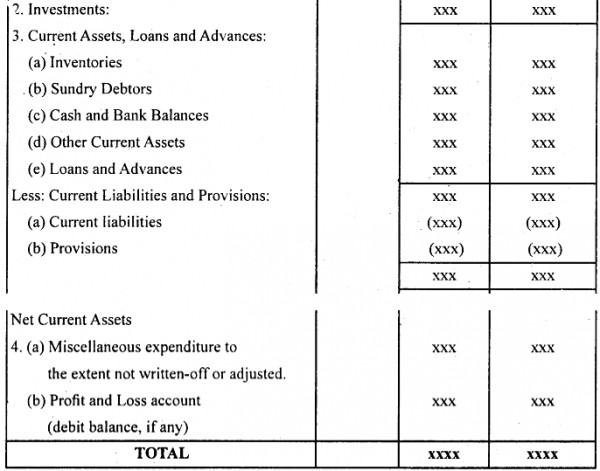

Prepare the format of balance sheet and explain the various elements of balance sheet. Vertical form of balance sheet

Prepare the format of balance sheet and explain the various elements of balance sheet. Vertical form of balance sheet

1. Share Capital: It is the first item on the Liabilities side. It consists of the following items:

• Authorised Capital

• Issued Capital: Equity share and preference share.

• Subscribed Capital less Call in Arrears add Forfeited Shares

2. Reserve and Surplus: As per the Schedule VI, it consists of the following items:

• Capital Reserve

• Capital Redemption Reserve

• Security Premium

• Other Reserve less Debit balance of P & L A/c

• Credit balance of P & L A/c

• Proposed Additions.

• Sinking Fund

3 . Secured Loans:

1. Debentures

2. Loan and advances from bank etc.

4. Unsecured Loans:

• Fixed Deposits

• Loan & Advances from subsidiaries

5. Fixed Assets: These are those assets that are used for more than one year, like:

• Goodwill

• Land

• Building

• Plant and Machinery

• Patents, Trade Marks

• Livestock

• Vehicles, etc.

6. Current Assets: Assets that can be easily converted into cash or cash equivalents are termed as current assets. These are required to run day to day business activities; for example, cash, debtors, stock, etc.

7. Current Liabilities: Those liabilities that are incurred with an intention to be paid or are payable within a year; for example, bank overdraft creditors, bills payable, outstanding wages, short-term loans, etc are called current liabilities.