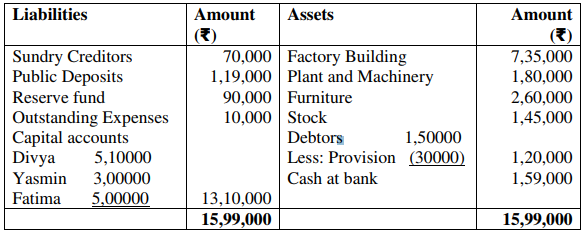

Divya, Yasmin and Fatima are partners in a firm, sharing profits and losses in 11:7:2 respectively. The balance sheet of the firm as on 31st March 2018 was as follows:

Balance Sheet As at 31.3.2018

On 1.4.2018, Aditya is admitted as a partner for one-fifth share in the profits with a capital of Rs. 4,50,000 and necessary amount for his share of goodwill on the following terms:

i. Furniture of Rs. 2,40,000 were to be taken over Divya, Yasmin and Fatima equally.

ii. A creditor of Rs. 7,000 not recorded in books to be taken into account.

iii. Goodwill of the firm is to be valued at 2.5 years purchase of average profits of last two years. The profit of the last three years were: 2015-16 Rs.6,00,000; 2016-17 Rs.2,00,000; 2017-18 Rs.6,00,000

iv. At time of Aditya’s admission Yasmin also brought in 50,000 as fresh capital

v. Plant and Machinery is re-valued to Rs.2,00,000 and expenses outstanding were brought down to Rs. 9,000. Prepare Revaluation Account, Partners Capital Account and the balance sheet of the reconstituted firm.