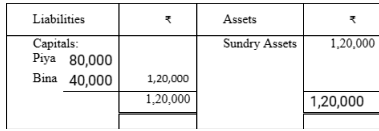

Piya and Bina are partners in a firm sharing profits and losses in the ratio of 3 : 2. Following was the Balance Sheet of the firm as on 31st March, 2016:

The profits Rs. 30,000 for the year ended 31st March, 2016 were divided between the partners without allowing interest on capital @ 12% p.a. salary to Piya @ Rs. 1,000 per month. During the year Piya withdrew Rs. 8,000 and Bina withdrew Rs. 4,000. Showing your working notes clearly, pass the necessary rectifying entry.