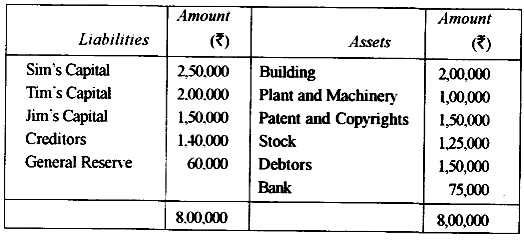

Sim. Tim and Jim are partners sharing profits and losses equally. Their Balance Sheet as on 31st March, 2012 stood as follows:

From April 1st 2012, the partners decide to share profits and losses in the ratio 3:2:1 and for that purpose the following revised value of assets were agreed upon : Building Rs 2,75,000; Plant and Machinery Rs 90,000; Patents and Copyrights Rs 1,32,500; Stock Rs 2,00,000: Prepaid Insurance Rs 5,000 and Debtors Rs 1,42,500. Goodwill of the firm was valued at Rs 60,000.

Partners decide not to disturb the reserves. Also, they decide not to record the revised values of assets in the books of Accounts.

You are required to prepare:

(i) Partner’s capital accounts.

(ii) Balance Sheet of the re-constituted firm.